Everyone wants to save money, right? We love to look for bargains and get great value for money, but did you know that you could be saving money on your bookkeeping costs by helping your bookkeeper or accountant save time? Time is money after all, and here are some top tips to help you.

1. Be on time

Your accountant or bookkeeper are usually very busy and have a lot of scheduled work to fit in, in a fixed amount of time. You may be able to negotiate a small reduction in fees if you can guarantee to always get your paperwork to them by a certain date, especially if it is in the first two weeks of the month.

2. Respond to queries quickly

In the same vein as above, if you respond to queries quickly your accountant will be able to get your work completed more efficiently. They won’t be spending unnecessary additional time repeatedly chasing you for paperwork or answers to their queries.

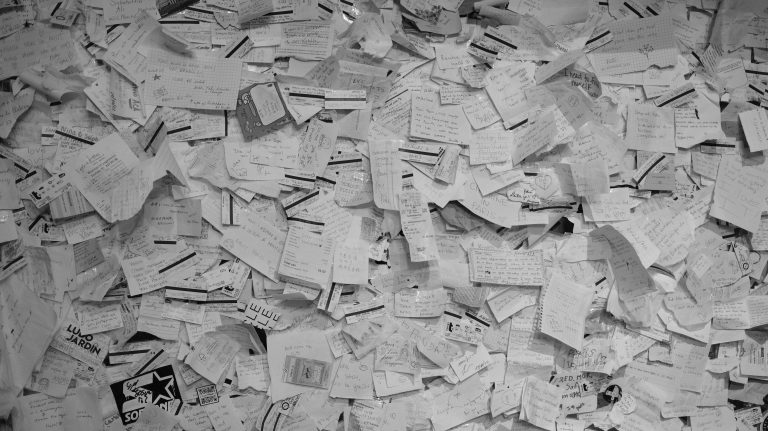

3. Upload all receipts and invoices as soon as you receive them

Make sure that you upload all your receipts and invoices to your accountant’s preferred data capturing software as soon as you receive them. If you have regular invoices from a supplier, you can link your account to most of the software, such as Dext, for example, and the invoices will automatically get uploaded. If you hand in a box of receipts, then you will be charged for your bookkeeper or accountant having to digitalise them for you.

4. Set up a bank feed in your accounting software

You can do this whether you use Xero or Quickbooks. You could also set a reminder to send your bank statements to your accountant each month too so that they can check that the balance in the software agrees with the bank statement. Sometimes the bank feeds can experience a blip and checking this regularly saves time.

5. Don't do it yourself unless you really know what you are doing

It really does take three times as long to fix errors as it does to do it correctly in the first place. Bookkeeping is complex and the rules are long and complicated. As for VAT… there’s a reason it takes around 4 years to study and train to be a professionally qualified bookkeeper.

6. Get some training

There are, however, some things that you can do, and your accountant can train you to do so. Get some training in the software so that you can do your sales invoices when they are paid so you always know who owes you money.

7. Set up automatic invoice chasing in your accounting software

You do need to make sure that you mark invoices off when they are paid though. No one likes being chased to pay something that they have already paid, right?

8. If in doubt, ask

If you are thinking of doing something in your business, like taking on an employee or buying a vehicle or piece of equipment, then always seek the advice from your accountant before doing so. A quick phone call to check it out could save you lots of money in the long run.

9. Pay your taxes on time

Make sure you’re using the correct references, which your accountant should give you each time you need to make a payment. Calls to HMRC take, on average, around 2 hours. Limiting the time that your accountant or bookkeeper needs to call HMRC on your behalf will reduce the cost to you.

10. Be more regular

The more often your bookkeeping is done, the easier it is to remember the answers to questions on missing paperwork. You and your accountant wouldn’t have to spend time trawling through Google to try and work out what you spent £25.00 on 18 months previously! Also, if you are not VAT registered, keeping a regular tab on your rolling 12-month turnover will help you avoid going over the vat registration threshold without realising; thus avoiding potentially losing 20% of your sales to HMRC.

11. Check bank statements

Make sure that you have sent everything across to your accountants, as some may charge for chasing up missing paperwork.

12. Be aware of key dates

Whether it’s PAYE, VAT, Self-assessment or Corporation tax – knowing when your taxes are due will help you to manage your time and plan more effectively.

13. Set up separate bank accounts

Save a bank account just for taxes – whether that be VAT, CIS, personal or Corporation tax. This could save you a lot of stress by always knowing that you have your outgoings covered.

Have anymore questions?

Visit our Top Tips and Blogs to get some more support for your business.