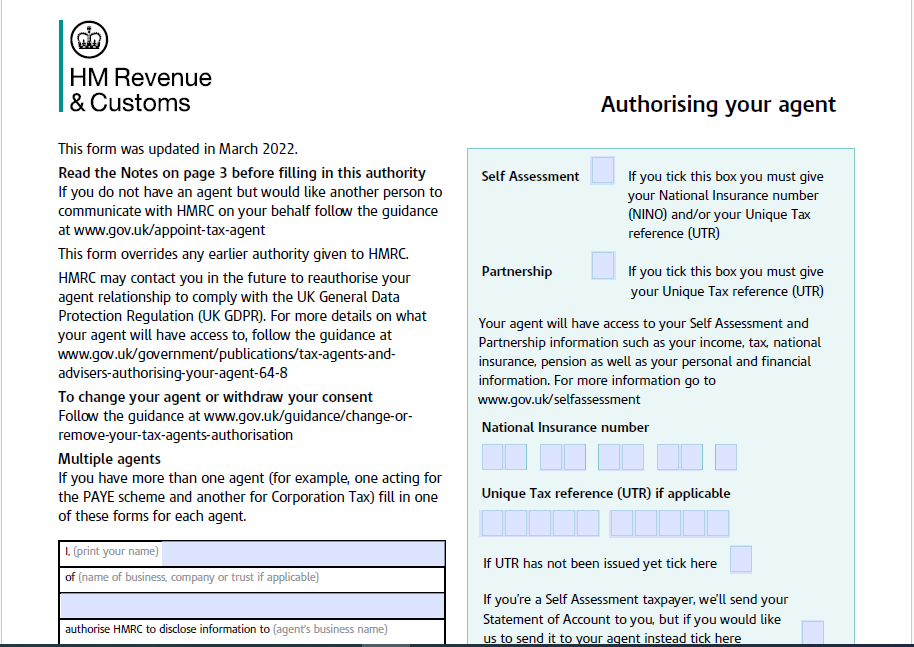

The simple answer is that this depends. If you have signed a 64-8 form that your

agent has presented you with and this has been posted to HMRC and they have received

and logged it, your accountant should be able to speak to HMRC on your behalf

about the taxes that have been ticked on the 64-8.

Just signing up as an agent online does not mean that HMRC will automatically talk to you. Even if you clearly have agent access online and have full sight of your clients tax details. This usually needs to be backed up with a physical 64-8 form. Interesting in the days of digitisation, when HMRC wants everything to be digitalised they still insist on a paper copy of a form.

It also depends upon what you are trying to do. For example, sometimes we are unable to

register for CIS over the phone with HMRC as they want to speak to the director

who is usually at the bottom of a foundation hole or atop a roof, hence wanting

their agent to be able to speak to HMRC on their behalf.

When setting up a payment plan the agent can do this, but

the directors will usually have to call HMRC themselves to authorise it. If the query is to do with self-assessment,

then more often than not, the agent will not be able to deal with the query

directly. Similarly, if someone needs to check a tax code or set up a payment

plan to pay their self-assessment tax they will need to speak to HMRC

themselves.

The good news however is that generally if the query is

related to VAT, PAYE, CIS or Corporation tax then the agent will be able to

deal with this on behalf of their client and they will not need to call HMRC

themselves as long as the 64-8 authority is in place.